There are compelling opportunities in the Kenyan market this first quarter (Q1) of 2026. After an in-depth study, there are 5 companies that look very promising to add to your investment platform, but only after you conduct your own research and verify facts. Let’s now start exploring these 5 promising stocks this year.

Let's start with Safaricom, this is the top pic for this Q1 of 2026. If you are a serious investor, Safaricom checks several boxes that are very important in stocks investment.

By now its clear that Safaricom since its founding in 1997 has built a rock-solid reputation for consistency.

They've been reliable with both interim and final dividend payments, which speaks volumes about their financial discipline and commitment to shareholders. That's not something you see everywhere thus making it a credible investment choice.

Second, public confidence in Safaricom is sky-high. This was evident when they issued their green bond. The number of people who bid for it was remarkable, showing that everyday investors trust this company with their money.

Third, the numbers are impressive. Safaricom reported a 63.1% surge in profit before tax for Q3 of 2025. That kind of growth that gets smart investors’ attention. When a company's fundamentals are strengthening like this, it's worth paying attention.

Equity Group is my second recommendation, and there's good reason for this. Truth be told, Equity Group is one of the best-performing banks not just in Kenya, but across the entire African continent. That's a significant distinction that makes it a great stock to watch out for.

Like Safaricom, Equity has proven itself as a dividend-paying machine. Whether it's interim or final dividends, you can count on them. Their Kenyan subsidiary, Equity Bank Kenya, has shown impressive improvement in its recent financials.

When the parent company and its subsidiaries are both performing well, that's a positive signal when it comes to buying of stocks.

NDM Group might not have the household name recognition compared to the first two, Safaricom and Equity, but the numbers tell a compelling story. In Q3 of 2025, they recorded 25.8% growth in profit before tax.

More importantly, this growth momentum has carried forward into 2026 and beyond, showing this isn't a one-quarter fluke.

Here's where things get interesting. HF Group recently made a significant pivot that saw it transitioning from a mortgage finance institution into a full-service retail bank.

In Kenya's financial landscape, retail banking is the backbone of the system. This strategic move positions them right where the action is.

The financial performance backs this up. HF Group posted a stunning 264% spike in profit after tax in their Q3 financials.

That's the kind of explosive growth that catches investors' eyes. The stock price reflects this momentum too.

One year ago, HF Group shares were trading at 4.7 shillings. Today, they're at 10 shillings per share. That's more than double in a year.

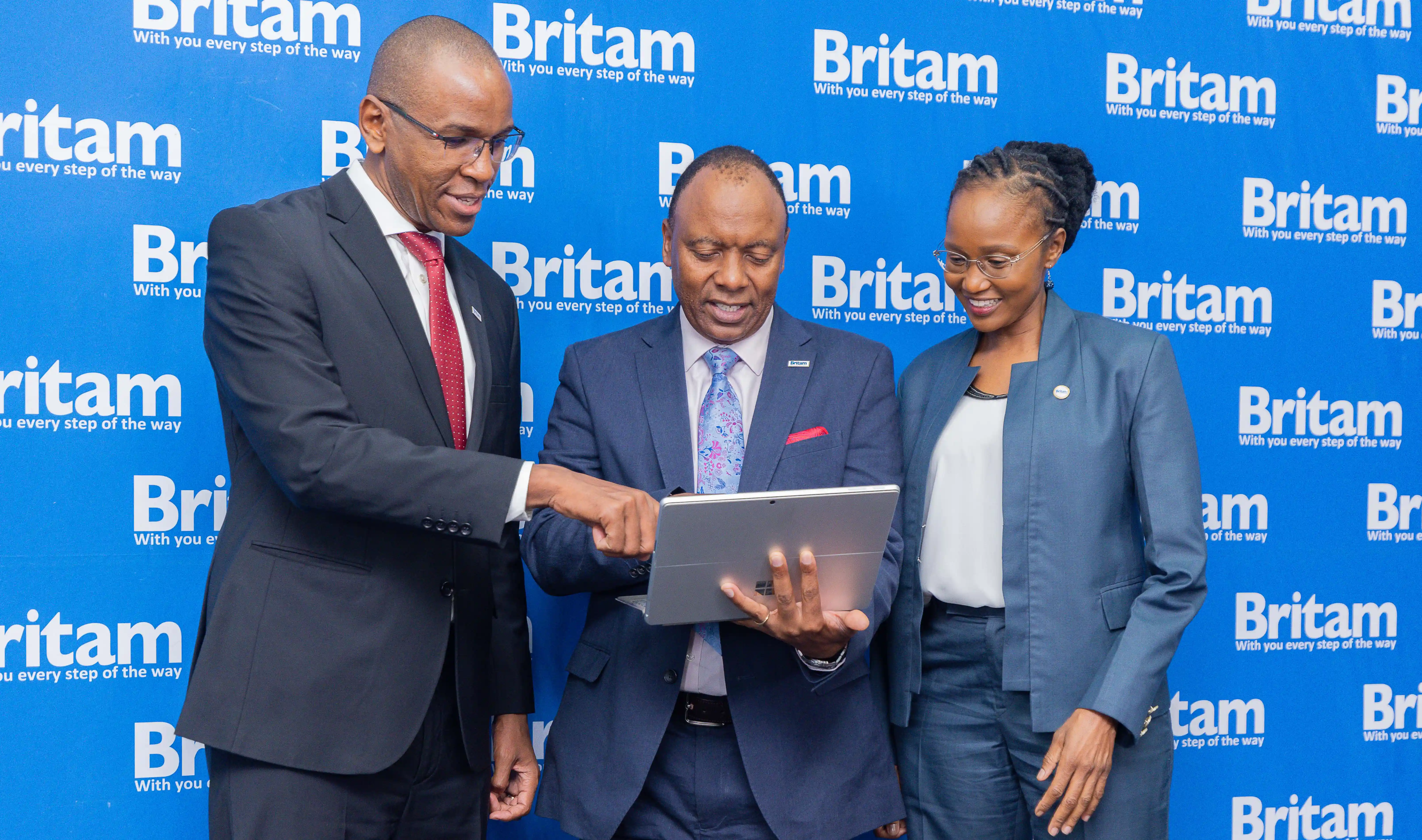

My final recommendation is Britam. In a diversified portfolio, you need exposure to different sectors. Britam leads in both life insurance coverage and general insurance, which demonstrates its market dominance and profitability.

Since 2021, Britam has shown consistent and significant growth in its financials. This isn't a company riding a temporary wave. They've built sustainable momentum over years.

These five stocks represent different sectors of Kenya's economy: telecommunications, banking, insurance, and financial services.

That diversity matters. Each company has demonstrated strong fundamentals, whether through dividend consistency, impressive profit growth, or strategic positioning.

The market always rewards investors who do their homework and invest with conviction. These stocks have given me reason for conviction in January 2026. Do your own analysis, consider your risk tolerance, and build a strategy that works for your goals.

Subscribe to our newsletter to stay.

I’m Clinton Wamalwa Wanjala, a financial writer and certified financial consultant passionate about empowering the youth with practical financial knowledge. As the founder of Fineducke.com, I provide accessible guidance on personal finance, entrepreneurship, and investment opportunities.

Leave a Comment:

Please log in to leave a comment.

Comments:

No comments yet. Be the first to comment!